Retirement Readiness

at a Glance

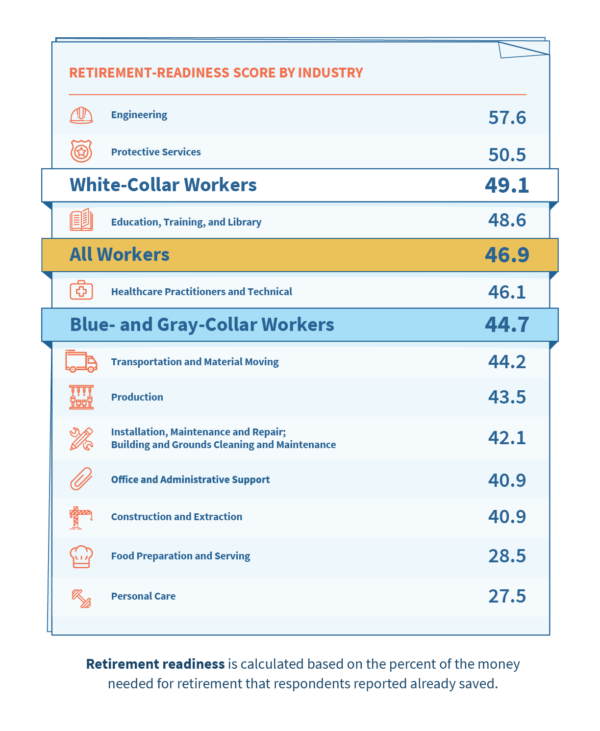

Understanding and comparing retirement-readiness scores of America’s workforce, industry by industry, shows there are important differences and surprising similarities across the occupations.

There is significant variation among specific blue- and gray-collar industries:

![]()

Eight of 11 blue- and gray-collar industries perform below the overall average for America’s workforce when comparing the retirement-readiness scores.

![]()

Food Preparation and Serving and Personal Care workers have the lowest levels of retirement readiness.

![]()

Engineering and Protective Services are performing above the norm of all workers when it comes to retirement readiness.

Access and

Information Impacts

Retirement Readiness

Access to planning information and financial options correlates with retirement readiness, furthering the disparities between employer size and industry.

Information is Key

![]()

More than half of Personal Care workers are not satisfied at all with the information provided by their employer, and 45 percent of Food Preparation and Serving workers feel the same.

![]()

More than one-third of workers from small businesses say their employer is “not helpful at all” in terms of retirement planning support and thus will frequently turn to family and insurance agents for advice.

Employees of midsized companies are most likely to look to human resources for financial planning assistance

American workers are satisfied with the amount of information their employer provides about retirement options.

Access Matters

White-collar workers are more likely than blue- and gray-collar workers to have seen an increase in access in the last decade.

![]()

1 in 8 American workers are not offered any type of retirement plan from their employer. For these individuals, retirement income planning is a “do-it-yourself” endeavor.

![]()

50%+ of all of America’s workforce reports their access to retirement plans and products has flatlined or decreased in the last decade.

![]()

Construction and Extraction and Engineering industries report the highest instance of significantly improving access to retirement plans and products over the last decade.

![]()

Food Preparation and Serving workers have seen a significant decrease in access.

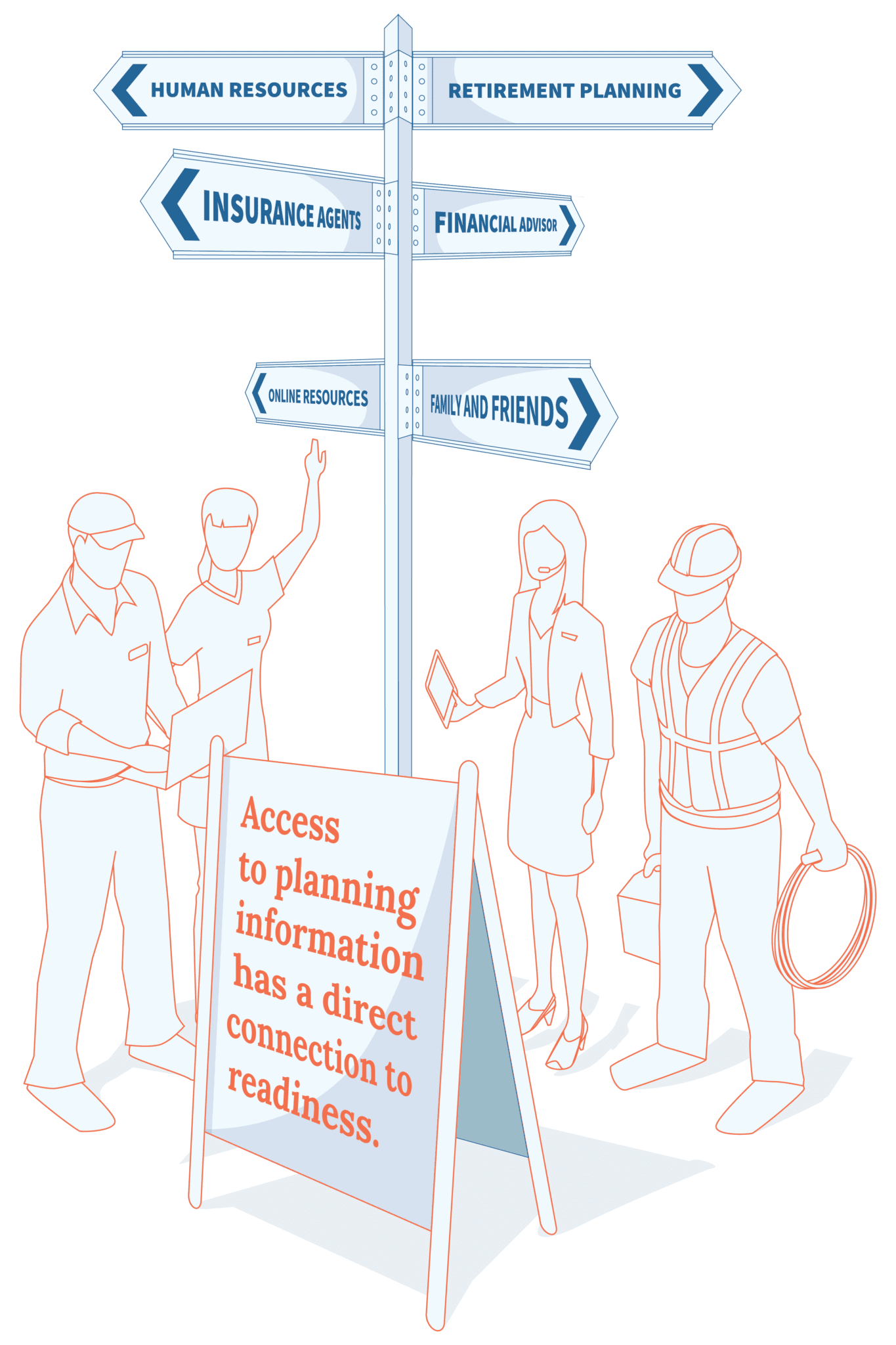

Larger companies tend to have higher satisfaction rates regarding the retirement options provided by their employers than those at smaller companies.

“Long-term planning is hard enough when we know all related variables, but retirement planning is riddled with unknowns, whether you have an employer-sponsored plan or not. One option to introduce certainty into the retirement equation is exploring a savings vehicle that provides a guaranteed lifetime income, like a fixed indexed annuity. This type of annuity leans into our desire for certainty by providing a steady stream of funds, helping Americans solve the complex math problem known as retirement savings.”

Kristen Berman, co-founder and principal at Common Cents Lab at Duke University and a collaborator to the study.

The Disparity Continues

Across all industries, employers have a significant impact on workforce retirement readiness.

Moving past employer impact shows opportunity and alignment. The quest for a stable income you can’t outlive is a goal shared by the majority of America’s workforce, with almost 80 percent reporting it as their number one retirement need.

“Fixed indexed annuities help to ensure a balanced financial plan while also being the one product in your portfolio to assure a lifetime income stream that is guaranteed.”

Jim Poolman, Executive Director of the IALC

Retirement

2030 and Beyond

The retirement scenario of the future is far removed from the traditional model of employer-sponsored retirement plan and full benefits after a lifetime career at a single place of employment. Currently, workers are controlling what they can to prepare for retirement.

Almost four in 10 workers will have to work part-time in their retirement years.

Nearly 10 percent of workers have switched jobs for better retirement benefits.

14 percent of workers are taking on a “side hustle” with the explicit goal of saving for retirement.

More than 40 percent of pre-retirement workers have already adjusted their lifestyle choice/expenses.

But that is only tinkering the edges, controlling what seems in reach. For America’s workforce, about sources of retirement income can make the difference in feeling comfortable and secure about what lies ahead.

Like never before, workers have the opportunity to research financial products, like fixed indexed annuities, that can provide a guaranteed lifetime income stream and balance to portfolios, while offering tax-deferred growth and principal protection from market swings. Find out if FIAs are right for you.

Take a Closer Look

The State of America’s Workforce research study set out to determine how America’s workforce is approaching retirement planning and preparedness, including their level of retirement readiness, associated emotions, challenges, barriers, and opportunities.

Learn more about the workforce’s retirement readiness, broken down industry by industry, and ideas for both employers and employees to improve our collective financial future by downloading the IALC’s corresponding white paper, The State of America’s Workforce: The Reality of Retirement Readiness.

Download the White Paper Download the Study’s Methodology

The information and data contained on this page is based on a large-scale, quantitative survey of working Americans conducted during March 2018 by Research Now on behalf of the Indexed Annuity Leadership Council (IALC).

Tool

Calculators

Use these calculators to get specific numbers and insights to match your retirement needs.

Resource

Planning Worksheet

Put pen to paper with a fill-in-the-blank worksheet to chart your retirement plan.