Americans’ Top Three Retirement Fears

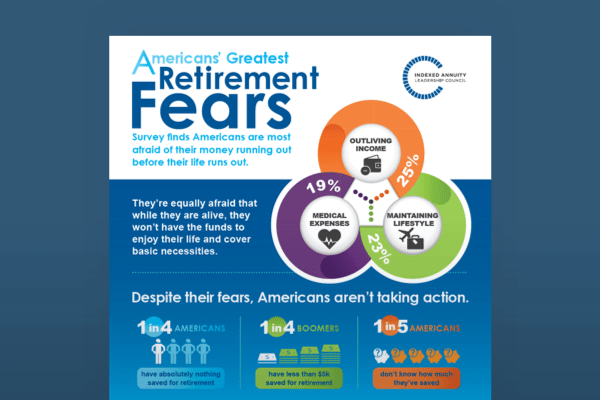

Americans are most afraid of their money running out before their life runs out, and almost equally afraid that while they are alive, they won’t have the funds to enjoy their life and cover basic necessities.

Running out of lifetime income

Maintaining their current lifestyle

Covering healthcare expenses

“As Americans are living longer, it’s no surprise the number one retirement fear is that their savings will run out, leaving them broke in their final years. The uncertainty of knowing if your retirement funds are enough to cover your entire life can be crippling. However, there are steps to create peace of mind, including establishing balance in your portfolio and paying yourself first by looking into retirement products, like fixed indexed annuities that offer a stream of guaranteed lifetime income.”

Jim Poolman

Executive Director of the Indexed Annuity Leadership Council (IALC).

However, Americans aren’t taking the necessary steps to address their concerns and mitigate the risks.

How Do You Stack Up?

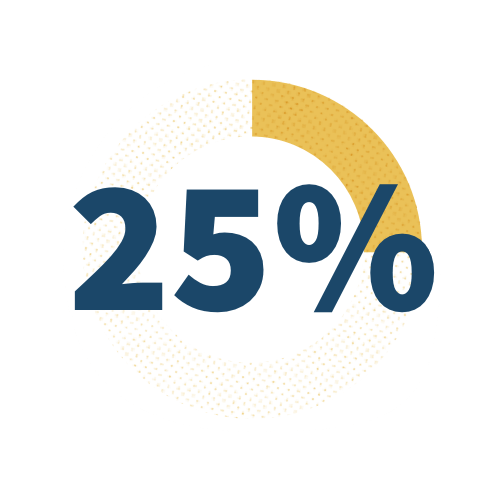

One in four Baby Boomers have less than 5,000 put away for their golden years.

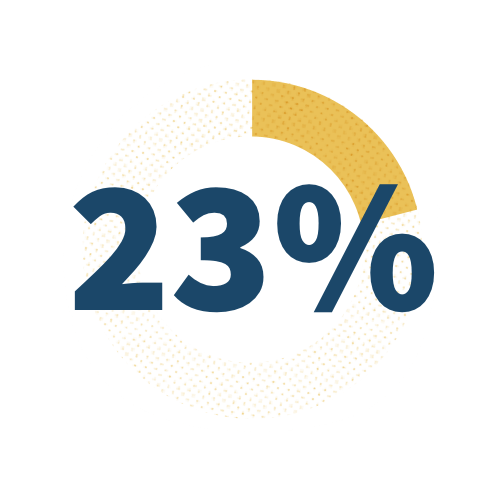

One in four Americans have absolutely nothing saved for retirement.

Nearly half of Americans are interested in retirement products, like FIAs.

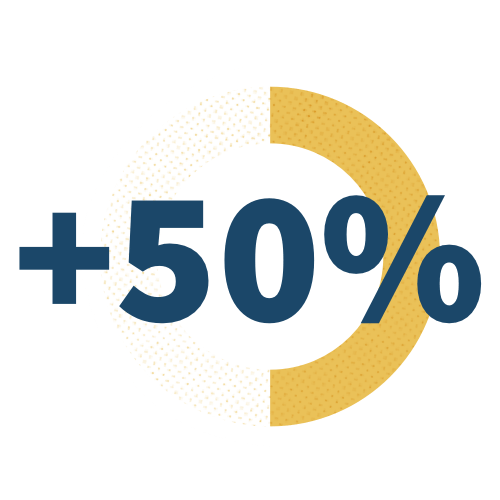

More than half of millennials have less than $5,000 saved.

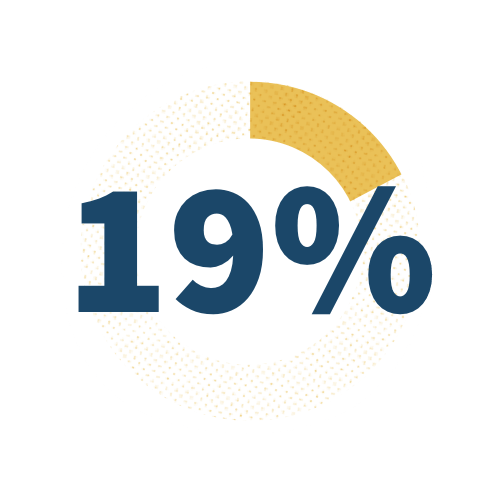

Nearly one in five Americans don’t have a clue how much they’ve put away.

Overcome Your Fears and Take Action

During retirement, no one wants to run out of money. Look for a financial product that provides guaranteed lifetime income, like FIAs, plus principal protection and interest rate stability to ease your fears.

Educational Content

Videos

Discover what can help with a secure and comfortable ride in retirement.

For

Retirement Savers

Fears thrive in misconceptions. Bust common myths and set the record straight.