New Data Shows Baby Boomers Have a Low Retirement IQ

While many Americans believe they’re retirement savvy, the average baby boomer has trouble answering even simple retirement questions. New survey data shows folks between 52 and 70 years of age have a significant gap in retirement knowledge, resulting in little action toward securing their golden years.

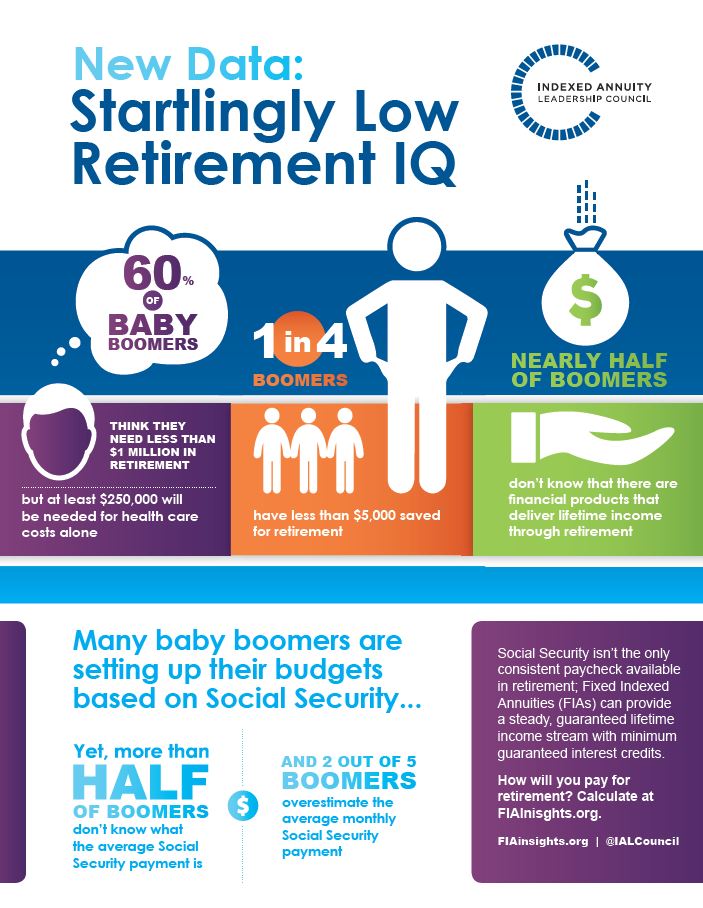

Our retirement IQ study found that:

- 60 percent of baby boomers think they’ll need less than $1 million in retirement.

- In reality, experts say the average American will need at least $250,000 in retirement for health care costs alone.

- 1 in 4 baby boomers have less than $5,000 saved for retirement.

- Reality bites: Retirement will likely cost much more!

- Close to ½ of baby boomers don’t know there are financial products that deliver lifetime income.

- The good news is there are products like Fixed Indexed Annuities that can provide lifetime income.

Our study also found that a majority of baby boomers are hoping that Social Security will help get them through retirement, yet more than 1/2 of baby boomers have no idea what the average monthly Social Security payment is. In fact, many overestimate the average by $500– a budget miscalculation that will leave them almost $250,000 dollars short over a 30 year retirement.

To see just how all-over-the-map baby boomers are when it comes to retirement, we took our cameras to the street and asked some basic questions. See how it went…

Cementing the lack of retirement knowledge out there, if given a gift of $20k, 40 percent of baby boomers said they would prioritize things like traveling and buying a new car over saving their money for retirement.

Although Americans may have good intentions when it comes to saving, they lack awareness of their options to do so and lack knowledge of how much they should be saving. Do you need a paycheck coming to you for your entire retirement? Calculating how much you’ll need for the entire length of retirement is a good first step. Then figure out what sources of savings and income will cover those costs. Check out IALC’s retirement calculators to estimate how much you’ll need in retirement.