Panic Grows About Living Too Long, Without Enough Money to Actually Live

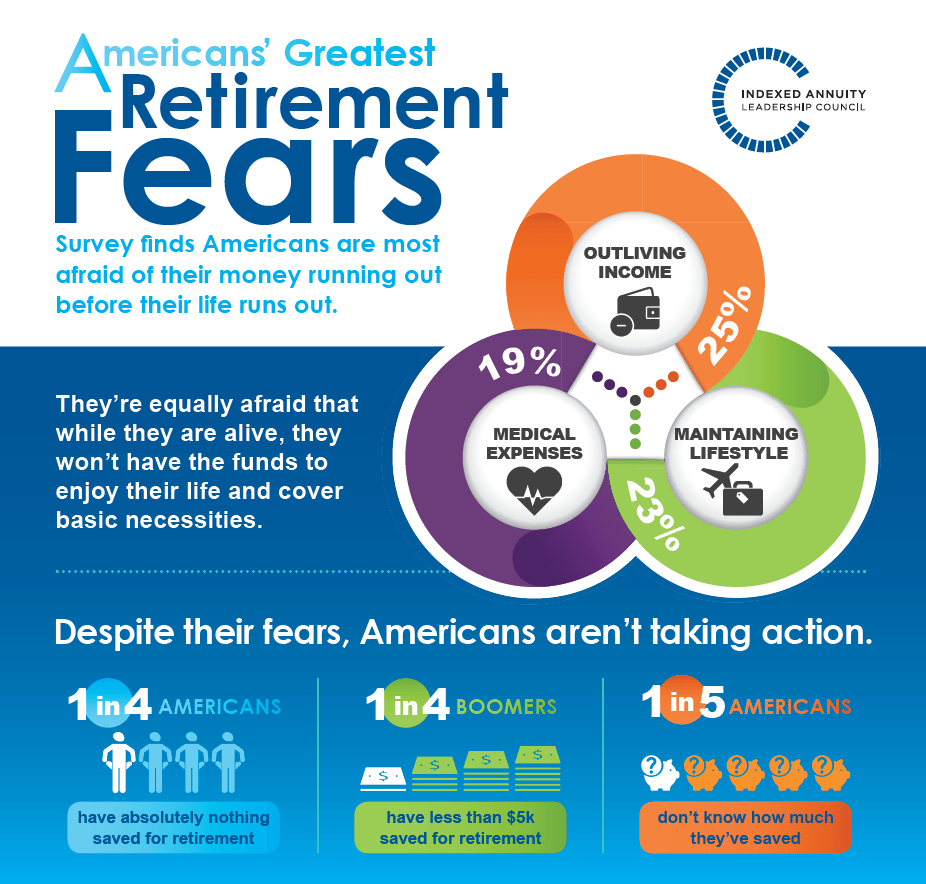

Imagine fearing life more than death. That’s a reality many Americans face as nearly 50 percent of Americans are afraid of outliving their income or their inability to pay for basic necessities like healthcare, according to a new survey released by the IALC.

However, Americans are not taking the necessary steps to put saving for the future over current expenses. In fact, a quarter of Baby Boomers – the age group closest to retirement – have less than $5,000 saved for retirement and nearly one in five Americans have no idea how much they’ve saved.

For context, find out how much you’ll need for retirement using a calculator here.

Not only are Americans worried they won’t have enough funds to get them through retirement, they’re also worried about having enough savings to cover basic necessities for the rest of their life. In fact, 1 in 5 Americans are most afraid of being unable to cover healthcare expenses. While Americans may be afraid of the unknown when it comes to allocating their money in retirement, they must budget for the unpredictable expenses such as healthcare expenses and life expectancy.

With Americans living longer than ever, they need to take steps now to mitigate risk and plan for a better retirement. Fortunately there are strategies and products available that offer guaranteed lifetime income, helping to ease the stress of stretching your nest egg to cover unexpected expenses for longer than anticipated.

To take control of your retirement planning and ease your worries about outliving savings, here are a few steps you can take today:

- Make a budget. Those who plan for retirement are estimated to save three times more than those who don’t. Take into account that your expenses may increase during retirement, specifically for items such as healthcare and travel.

- Build a balance. Investing in a 401(k) is a great way to start a retirement portfolio, but it’s important to keep a balanced portfolio to protect against market swings. One method to provide balance to your retirement portfolio is to add some more conservative, low-risk products, such as Fixed Indexed Annuities (FIAs), which protect your principal regardless of market ups and downs. According to the survey, products like FIAs are an attractive choice for consumers, with 45 percent of Americans surveyed interested in this type of retirement product.

- Plan to adjust. A savings strategy that makes sense today might not fit your needs in five, 10 or 20 years. Assessing your investment mix at different stages in your life is key – when you’re young, a higher-risk investment strategy may be more effective, whereas the closer you are to retirement, the more important a low-risk portfolio may be, with more conservative products such as Fixed Indexed Annuities.