As a retirement saver, we know the tax reform debate of 2017 reawakened the need for you to examine and evaluate your retirement savings plans and educate yourself on all available options for planning. Our educational videos on retirement planning and fixed indexed annuities (FIAs) is great place to start.

Examining Your Retirement Preparedness Plans

We suggest examining your retirement preparedness plans to ensure you are saving enough now. Financial certainty can be improved if you utilize financial resources, such as the Indexed Annuity Leadership Council’s (IALC) retirement calculators, to estimate your retirement living expenses and determine how much Social Security you’ll receive each month.

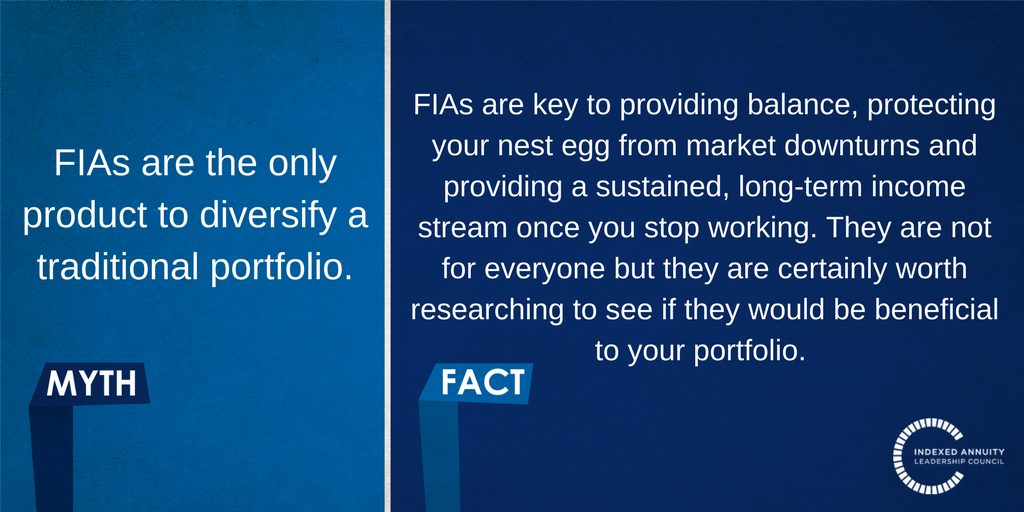

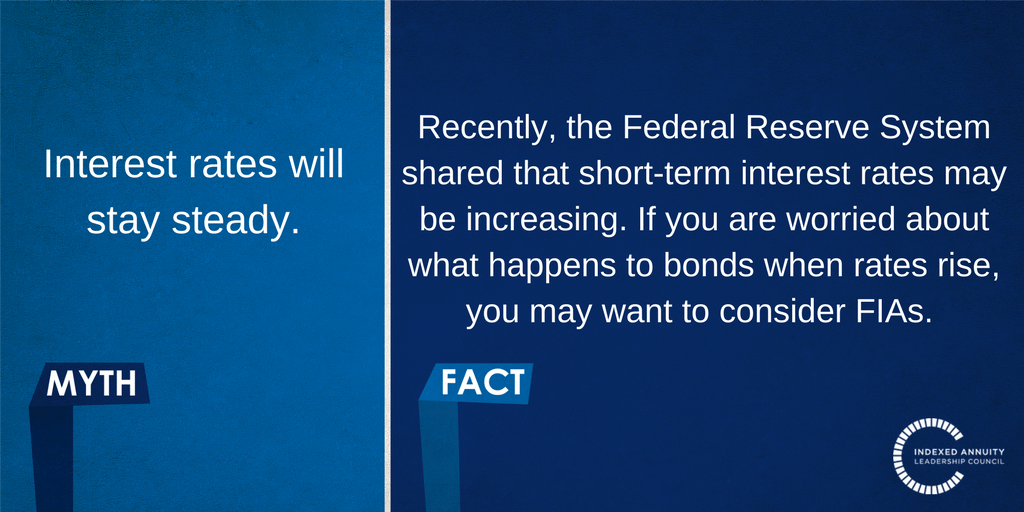

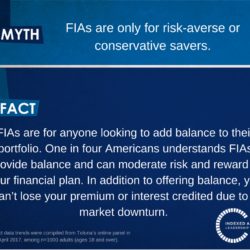

Diversifying portfolios and adding an array of options will also help maximize potential gains and minimize risks. Not putting all your eggs in one basket is key for successful planning.

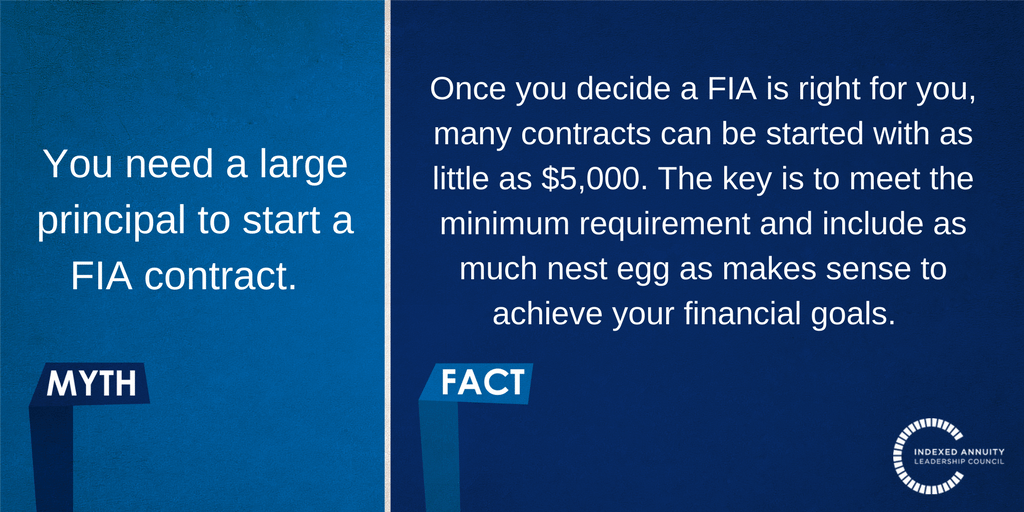

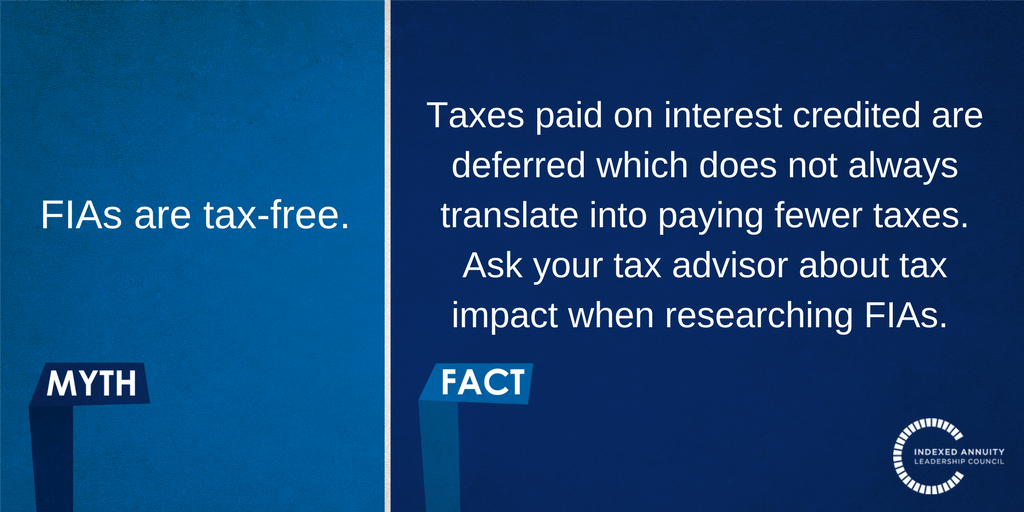

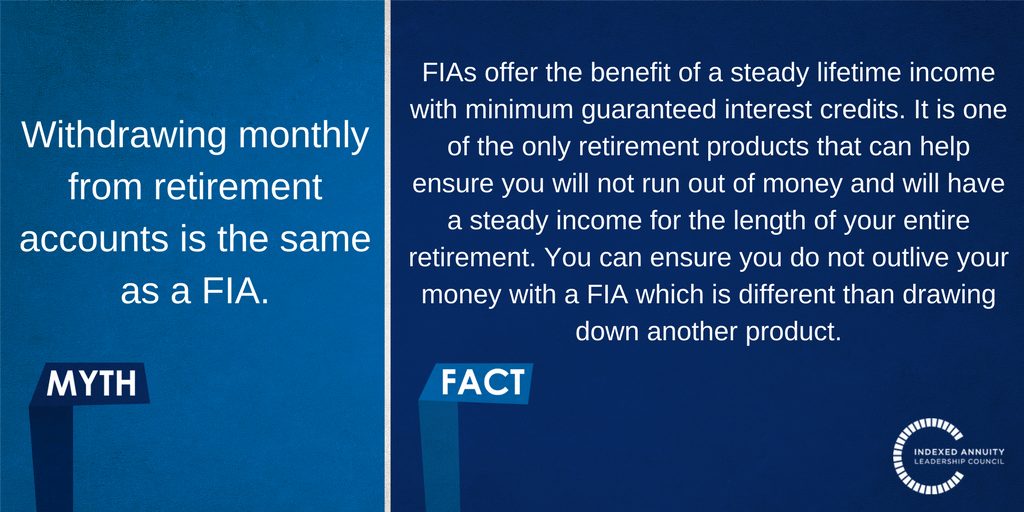

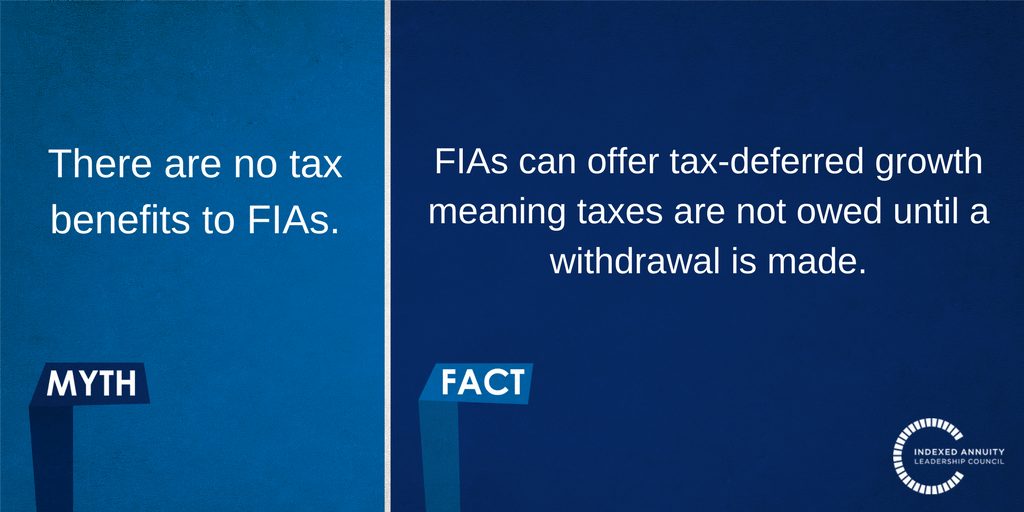

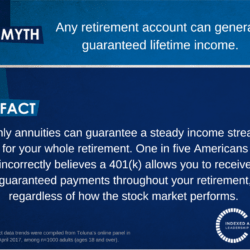

One option to consider adding to your financial portfolio is a fixed indexed annuity (FIA), which can provide balance to financial plans and offer a steady stream of income in retirement. FIAs also offer tax-deferred growth, meaning taxes are not owed until a withdrawal is made. Complete our Retirement Planning Worksheet to see if an FIA is right for you.

Read on to learn more about the FIA facts and the changing face of retirement.

Retirement in America is Changing

You have what it take to guarantee a retirement that fits your needs. Retirement comes in all shapes and sizes. Get a snapshot of retirement in America from our Executive Director Jim Poolman.

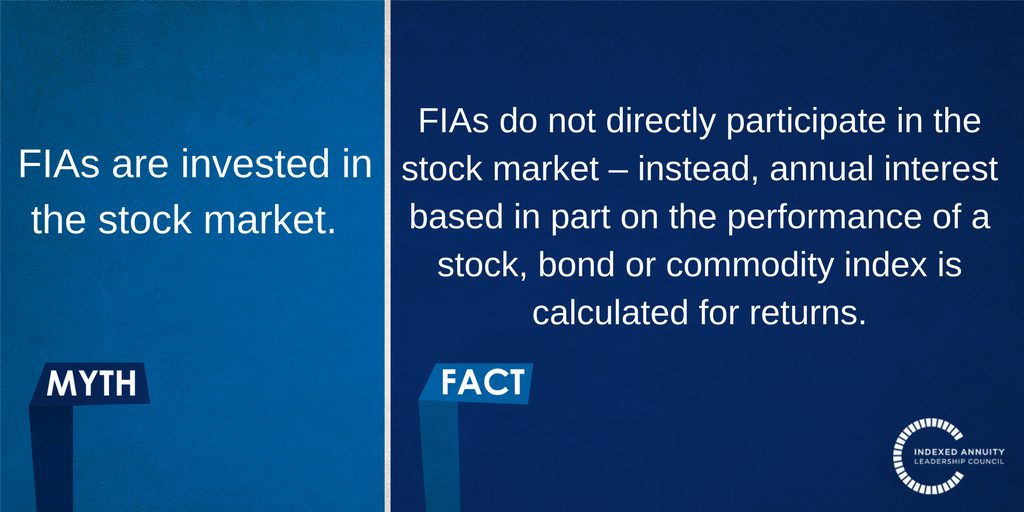

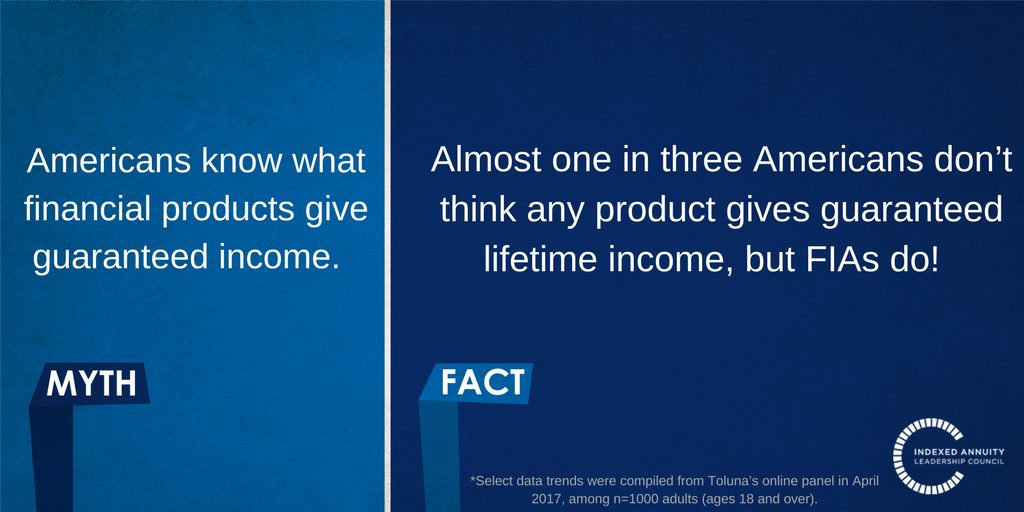

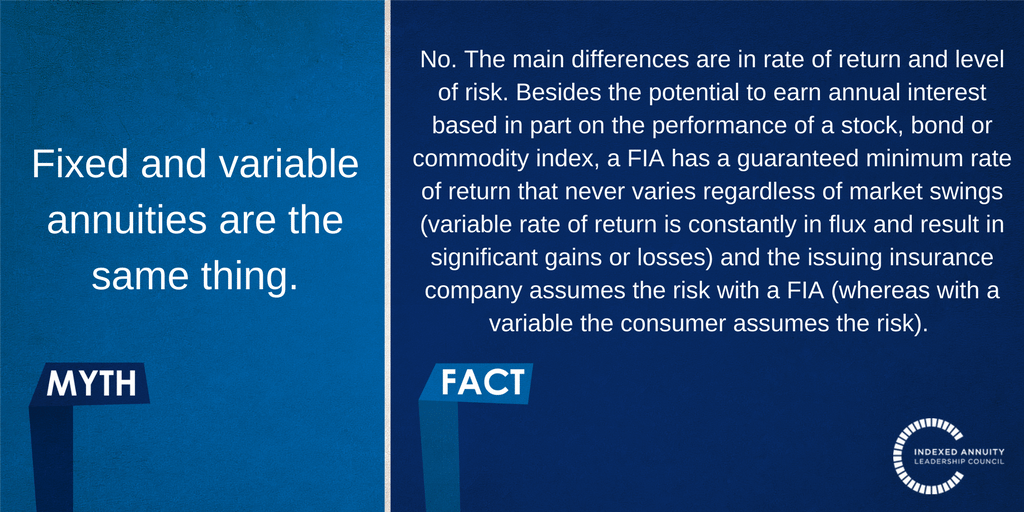

Can you sort fixed indexed annuity (FIA) fact from fiction?

It’s no myth, there is a retirement crisis in America. In fact, IALC data found one in four baby boomers have less than $5,000 saved for their golden years.

Lack of diversity further puts retirement at risk and only nine percent of America is prioritizing financial diversity. A diversification strategy is essential to ensure balance and provide retirement planning peace of mind.

That said, it can be hard to create diversity if you don’t know what products to add to your portfolio. The same study found 22 percent of Americans are not familiar with the most routinely used retirement products, such as mutual funds, Certificate of Deposits (CDs), and FIAs, which are a great product to diversify.

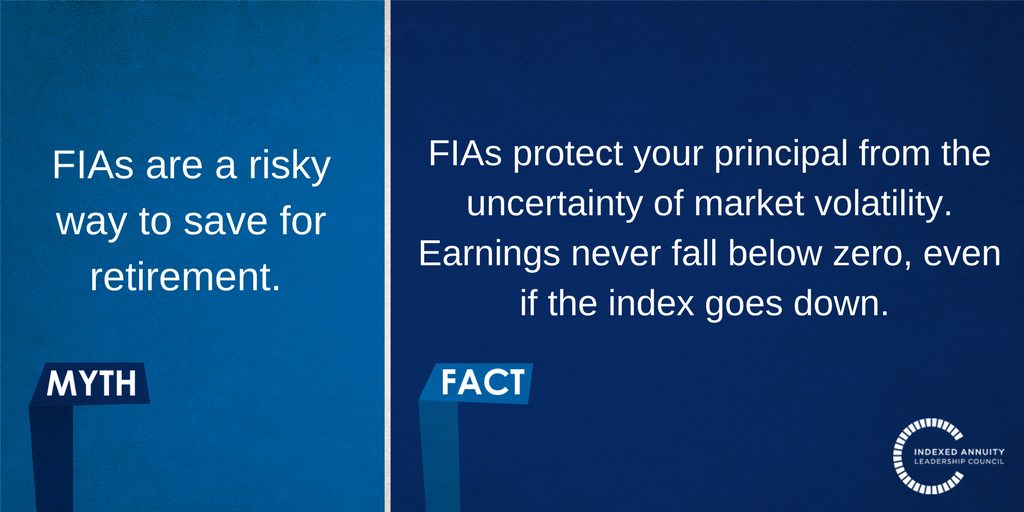

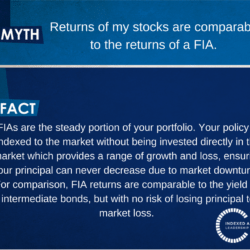

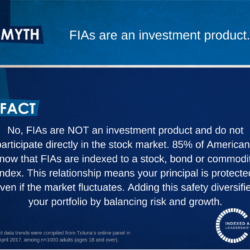

A common misconception is that FIAs are too complicated or complex. However, FIAs offer a simple story: growth potential, without risk of loss, due to market downturns, as well as a steady income stream in retirement.

Together, let’s uncover many of the other myths on diversification, FIAs, and more.

Research

Retirement IQ

What’s your retirement IQ? Learn where you stack up among other pre-retirees.

Blog

Points to Ponder

As you plan for the years ahead, stay up-to-date with recent news and retirement insights