When you think about retirement, what are your goals? For most people, the answer is a nice balance between stability, favorite pastimes, and new adventures. Balance is also important in your financial life: between reward and risk, nest egg preservation, and growth.

No one knows what the future holds. That’s why fixed indexed annuities (FIAs) should be considered by retirement savers looking for peace of mind no matter what happens in the financial markets.

We promise no pop quizzes or grades. Just solid, simple information from “what is an FIA” to “how annuities differ” to “how to tell if this retirement vehicle may be right for you.” Ready, set? Let’s learn.

What is an FIA?

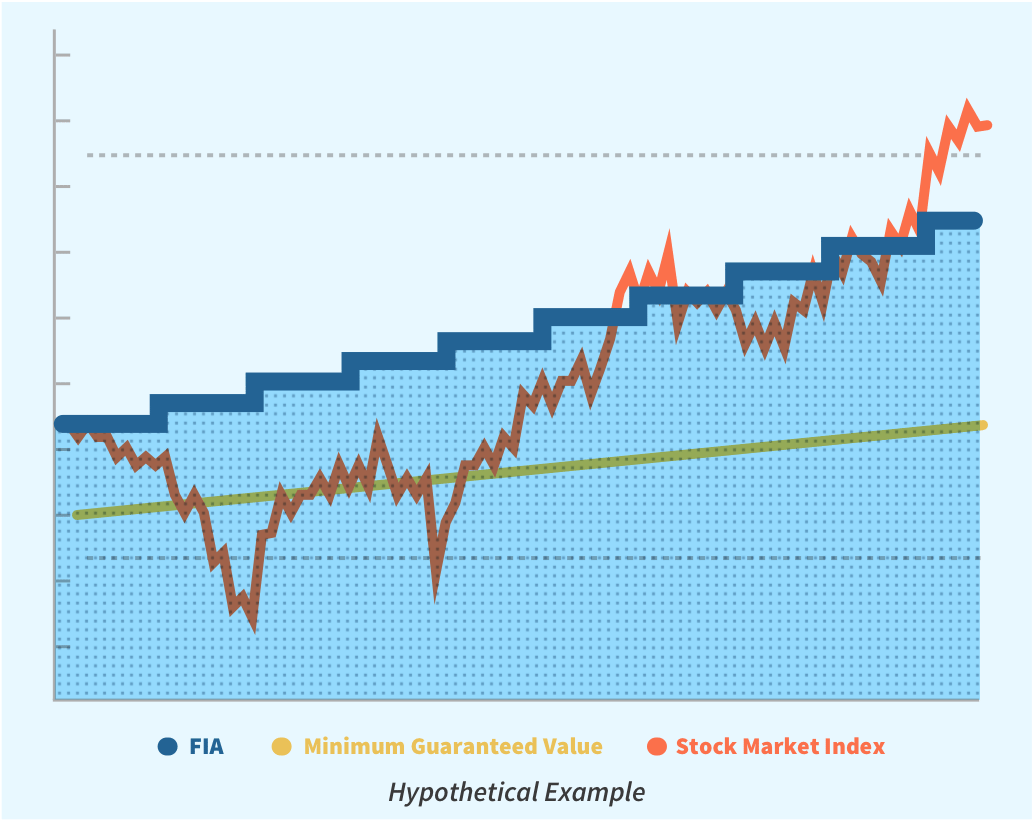

A fixed indexed annuity (FIA) is a contract between you and an insurance company. FIAs offer the opportunity for tax-deferred growth based in part on changes in a market index, plus the option to convert your annuity into a steady, guaranteed, lifetime income stream, all while protecting your hard-earned principal from the uncertainty of market volatility.

When purchasing an FIA, you agree to pay for it in either a single lump sum or multiple payments over time. In return, the insurance company takes the risk of market downturns to protect your annuity value and also promises to make payments from the annuity to you in a single payment or series of payments, over a fixed number of years.

Money in an FIA earns interest based on changes to the index. Annual interest is calculated using a unique formula based on changes in the performance of stocks (S&P, Dow Jones, NASDAQ), bonds (Capital Markets Bond Index), or commodities (CBUE). The index is used as an external benchmark – you do not actually invest your funds in it.

How an FIA Works

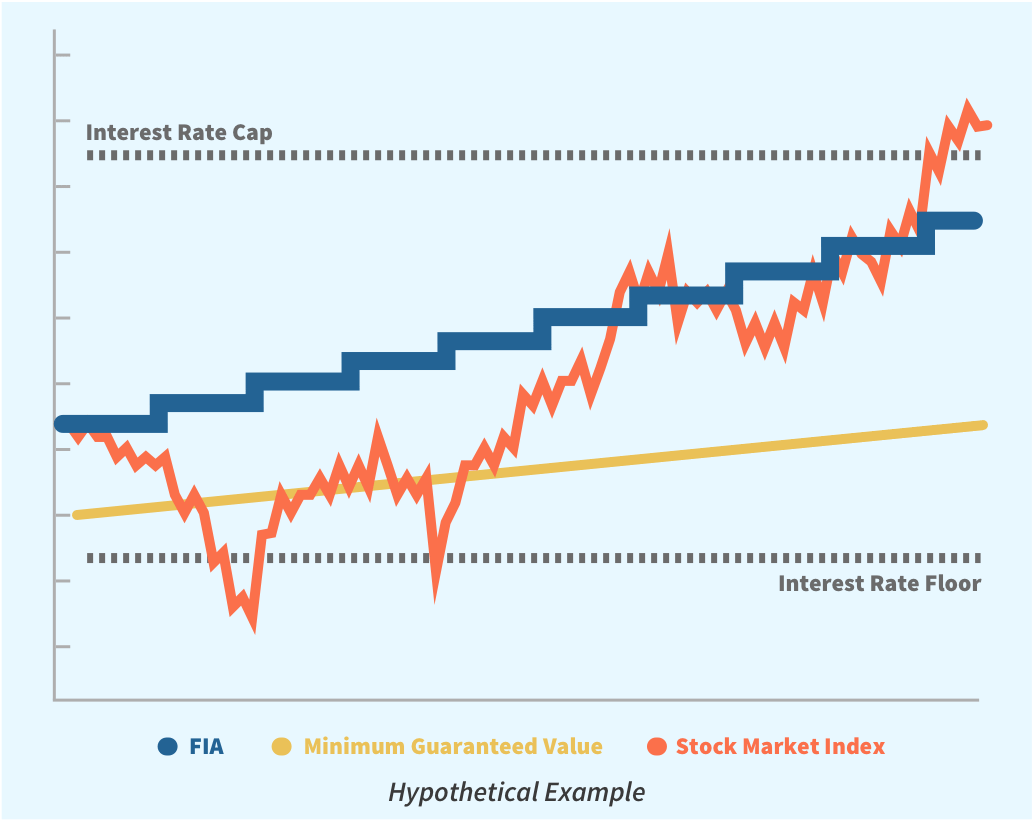

Generally, fixed indexed annuities (FIAs) have an interest rate floor, which is the minimum interest that will be credited each period – typically 0%, a participation rate, which is the percent of an index that will be used to calculate interest crediting, and/ or a cap, which is the maximum interest that will be credited. Together, the interest rate floor, participation rate, and cap determine the amount of interest you earn. Your interest earnings rate will always remain somewhere between the floor and the cap. It will not rise above the cap, even if the index goes higher. Conversely, it will never fall below zero, even if the index declines in value. In fact, the value of your money will never decline due to market loss for as long as it is in the FIA, although it can increase with a rising index.

If you withdraw your money from an FIA before an index terms ends, the annuity may not add all the index-linked interest for that term to your account. Additionally, like many long-term financial products, like CDs or mutual funds, FIAs have a surrender fee for early withdrawal, the terms of which depend on your contract.

Differences Between Annuity Types

There are a few different categories of annuities, each with its own unique set of characteristics. Keep in mind both fixed and variable annuities are types of deferred annuities. Additionally, fixed indexed annuities (FIAs) are a kind of fixed annuity and an indexed variable annuity is a type of variable annuity.

Fixed Indexed Annuities (FIAs)

FIAs are contracts between you and an insurance company. Regardless of market swings, this financial product guarantees a minimum rate of return for a fixed number of years. Interest is earned based in part on changes in a market index, which measures how the market, or part of the market, performs. Other characteristics of FIAs include no risk to your principal, tax-deferred growth, and the ability to create an income stream you can’t outlive. State insurance commissioners serve as the regulatory authority and states are required to have life insurance licenses to sell the product. For FIAs, the insurance company assumes the risk.

Variable Annuities

Variable annuities, sometimes called shield annuities, are contracts that offer a rate of return depending on the stock, bond, or money market investment. In variable annuities, the buyer makes a lump-sum payment or series of payments. In return, the insurer agrees to make periodic payments beginning immediately or at a future date. While returns are not guaranteed, variable annuities offer tax-deferred growth. Purchase payments are directed to a range of financial products, called sub-accounts, which are managed similar to mutual funds, or directly into the separate account of the insurance company that manages the portfolios.

The value of the account during accumulation, and the income payments after annuitization vary, depending on the performance of the investments selected. The consumer assumes the risk. For variable annuities, the U.S. Securities and Exchange Commission (SEC), the Financial Industry Regulatory Authority (FINRA), and state insurance commissioners serve as the regulatory authority. Series 6 registration issued by FINRA, as well as a state-issued representatives are required to have life insurance licenses if they want to sell.

Fixed Annuities

Fixed annuities are contracts in which the insurance company makes fixed dollar payments to the annuitant for the term specified in the contract, usually through the lifetime of the annuitant. Like FIAs, the insurance company guarantees both earnings and principal. Other characteristics include tax-deferred growth. State insurance commissioners serve as the regulatory authority and states are required to have life insurance licenses to sell the product. Once again, the insurance company assumes the risk.

Indexed Variable Annuities (IVAs)

IVAs are contracts that provide the opportunity to grow your assets, with some level of risk that is dependent on the performance of the investments selected. IVAs offer a level of protection with index strategies, performance potential through variable options and/ or index options, income options, and death benefit options. In IVAs, the buyer makes a payment in one or more payments. The consumer assumes the risk.

Check out the National Association of Insurance Commissioners (NAIC) complete buyer’s guide for more information on all deferred annuities.

Get the Basics of Indexed Annuities

View our infographic for more on the basics of FIAs.

Educational Content

FIA Benefits

Discover how FIAs may be a great retirement vehicle for you.

Retirement Priority

Is an FIA Right for You?

Before placing a portion of your nest egg into an FIA, understand if it’s right for you.