Part Two – Myth vs. Fact: Lack of Portfolio Diversity Puts Retirement At Risk

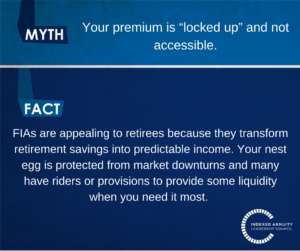

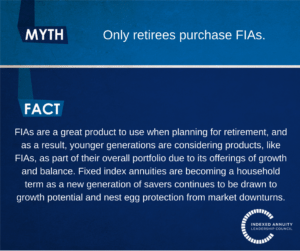

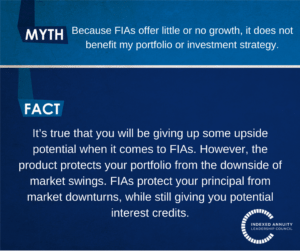

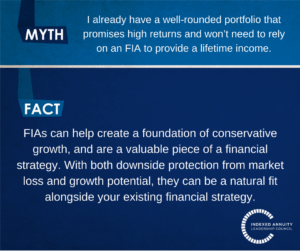

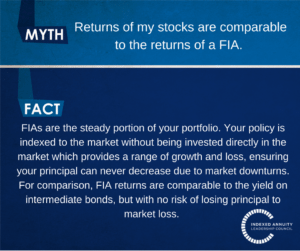

While the stock market continues to perform well, everyone remembers the down turn in 2008. In order to protect yourself and your finances from these market swings, it’s important to take steps towards balancing your portfolio. As a long-term saving strategy and a way to balance a retirement portfolio, Fixed Index Annuities (FIAs) are appealing because they transform savings into predictable income.

In Part Two of the Myth vs Fact series, the Indexed Annuity Leadership Council debunks more commonly held misconceptions about FIAs.

To see more myths debunked, check out Part One of the series – NEW DATA: EXTREME LACK OF DIVERSIFICATION COULD ADD TO RETIREMENT CRISIS.

*Select data trends were compiled from ORC International’s online panel in April 2017, among n=1000 adults (ages 18 and over).