Retirement Talk among Parents and Children Taboo

By Wendy Waugaman, CEO & President, American Equity Investment Life Holding Company

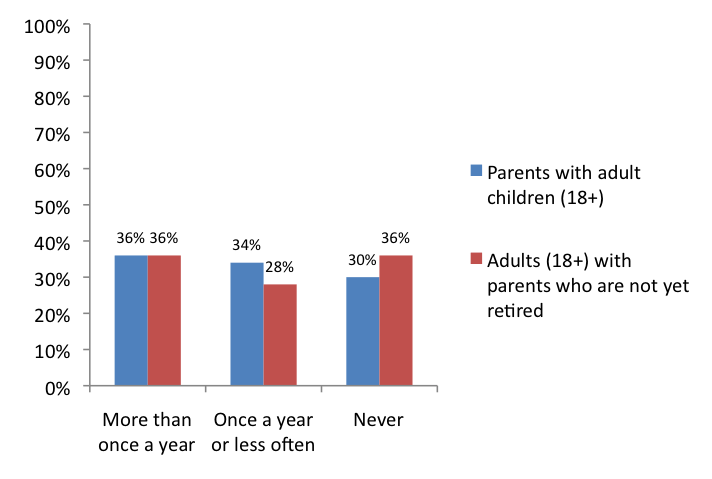

Planning for retirement is on the minds of parents and their children alike. But a new survey conducted for the IALC finds that adults are reluctant to talk about it. The Survey on Generational Retirement Perspectives found that over a third of adults (36%) say they never talk to their parents, who are not yet retired, about retirement plans. Similarly, a third (34%) of parents talk to their adult children (18+) about their financial retirement plans once a year or less (as indicated in the graph below).

Graph 1: How often Parents and Adult Children Discuss Retirement Planning with Each Other

Although parents and their adult children aren’t discussing retirement plans in a consistent, significant manner, they are worried about each other’s financial future. The Survey on Generational Retirement Perspectives found that more than half (54%) of parents with children 18 and older believe they are at least a little responsible for ensuring their children have enough money on which to retire someday.

And a majority (56%) of adults, with parents that are not yet retired, are at least a little concerned that they may have to financially support their parents after they retire.

It’s time to stop some of the worry! Taking control of your financial future can provide peace of mind for you and your family members. Families that engage in an open dialogue about retirement and retirement planning are taking the first step towards taking control.

If you’re not sure where to start, talk to a retirement planning professional to see what options make sense for you and your family. There is no one-size-fits-all decision when it comes to planning for your future.

To see more about the survey, check out our Survey on Generational Retirement Perspective page.