Three Ways to Minimize the Tax Burden on Retirement Income

Tax day is coming up in just a few weeks and while tax filing will never be fun, some planning now can make a big impact down the road when it comes to dealing with taxes during retirement.

As with many financial considerations, planning ahead is key. By beginning to think about retirement years ahead of time and organizing a financial strategy that allows for guaranteed income and security, retirement can be one of the most rewarding periods of your life.

1. Once you retire, financial flexibility becomes more important than ever. Flexibility allows you the freedom to enjoy new hobbies, travel or spend time with family and friends. What’s more, it allows for you to control your income throughout the year and stay in lower tax brackets, minimizing your annual taxes. One important way to improve your flexibility is to eliminate major expenses before you retire. For example, paying off your mortgage—one of most households’ largest expenses— can allow you to use your retirement income for a variety of other purposes or simply continue to save.

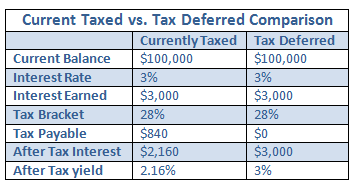

2. Develop a withdrawal plan that lets you stay in lower tax brackets. Many retirement-focused vehicles are tax-deferred, meaning that you are only taxed on them once you withdraw funds. By planning in advance and developing and sticking to a budget, you can make sure you don’t exceed certain tax brackets and are able to limit income tax.

3. A Fixed Indexed Annuity, or FIA, can play an important role in your retirement planning process as it provides a low-risk vehicle that can provide guaranteed lifetime income. What’s more, FIAs can help you minimize your tax burden. This tax deferral is important because it allows even faster growth of the annuity. In addition, FIAs don’t have government-mandated contribution limits. That means you are allowed to save as much as you would like. Finally, once you begin to withdraw (or annuitize) the funds, only the interest will be taxed – leaving your principal tax-free when you need guaranteed income the most.

Taxes are a key consideration in any financial planning. In order to enjoy a secure and comfortable retirement, take the necessary steps now to minimize your tax burden and develop a diversified portfolio of products which will provide the most financial security. For more information on how to reduce taxes in retirement, check out this interactive calculator that will allow you to prepare for multiple scenarios.