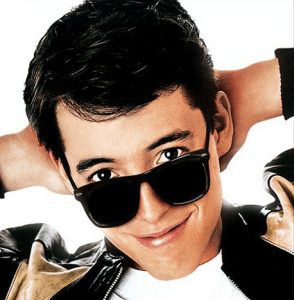

Time for Ferris Bueller to Consider an FIA

Though it may seem unbelievable, Ferris Bueller’s Day Off came out in theaters 30 years ago today (June 11), making Matthew Broderick’s character about 48 years old.

Now, of course we don’t know the career and lifestyle that Ferris and his friends went on to experience after that life-changing day in 1986 Chicago. But, we do know that today, Ferris would be in the latter half of his career, potentially with kids of his own soon going away to college and a growing realization that retirement is not as far away as it was on that June day three decades before.

Now, of course we don’t know the career and lifestyle that Ferris and his friends went on to experience after that life-changing day in 1986 Chicago. But, we do know that today, Ferris would be in the latter half of his career, potentially with kids of his own soon going away to college and a growing realization that retirement is not as far away as it was on that June day three decades before.

In fact, Ferris might be more concerned about his retirement prospects than he would let on. A recent Ipsos study found that confidence in traditional programs like Social Security is weakening and that 54 percent of Americans have never spoken with a financial adviser. Even more worrisome, the average American just slightly younger than Ferris would only have $42,700 saved for retirement.

Luckily, Ferris and his friends are the right age to consider a fixed index annuity (FIA). An FIA is an insurance product that pays you income in exchange for a premium. It allows you to enjoy potential growth that’s linked to a market index, while protecting your savings from any downside loss. It can even provide guaranteed lifetime income throughout retirement.

By planning ahead and looking into an FIA, Ferris – at only 48 years old – can take steps to secure a retirement that is every bit as exciting and fun as his time playing hooky that epic day on Michigan Ave.